According to a new study, 64 percent of North American people buy crypto currencies without conducting "any research at all."

As the crypto ecosystem continues to develop, it is becoming increasingly important for investors to have a basic grasp of it to navigate it safely and securely.

When speaking about investing in crypto currencies, the phrase "crypto literacy" refers to an investor's level of knowledge and comprehension of the ecosystem of digital assets. It's possible that the suddenness and extent of recent market drawdowns caught off ordinary investors who weren't paying attention.

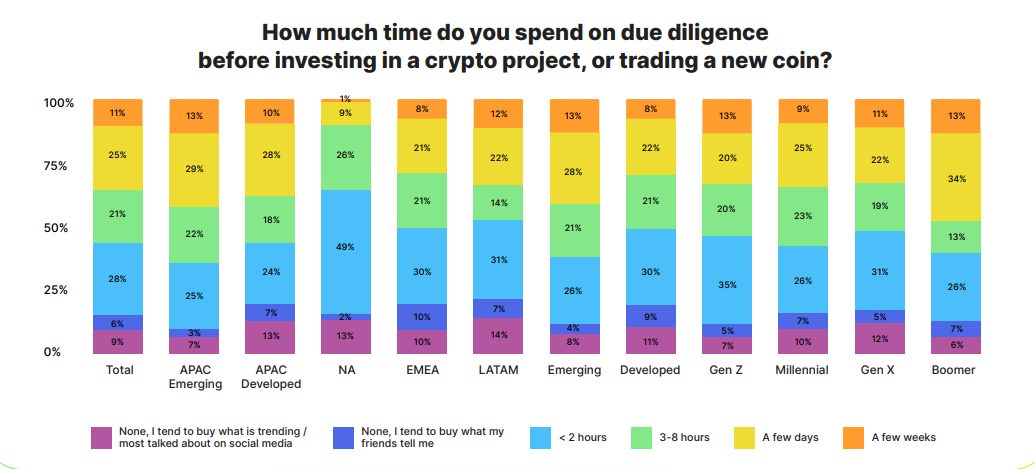

According to the Crypto Investment Literacy report published (1) on January 16 by Bybit and Toluna, in particular, 64% of North American investors either spend less than two hours researching before making an investment in crypto currency or don't perform any research at all.

Doing one's study and analysis is required before making choices on how to spend money on investments. On the other hand, just one in three bitcoin investors does research for more than two hours before investing.

The countries that make up the growing economies of Asia and the Pacific invest the greatest time and effort into research. Surprisingly, when we look at the different generations, we find that Boomers are the ones that spend the most time completing their research.

In contrast, Baby Boomers are demonstrated to be the most risk-aware and careful investors. Before investing, 34% of Boomers spend a few days conducting their research, which is 50% more than previous generations.

Due Diligence Procedures for Crypto currencies

In addition, the study results reveal that Baby Boomers, on average, are 20% wiser than earlier generations since they focus more on technical characteristics. This is because Baby Boomers were born in the 1950s and 1960s.

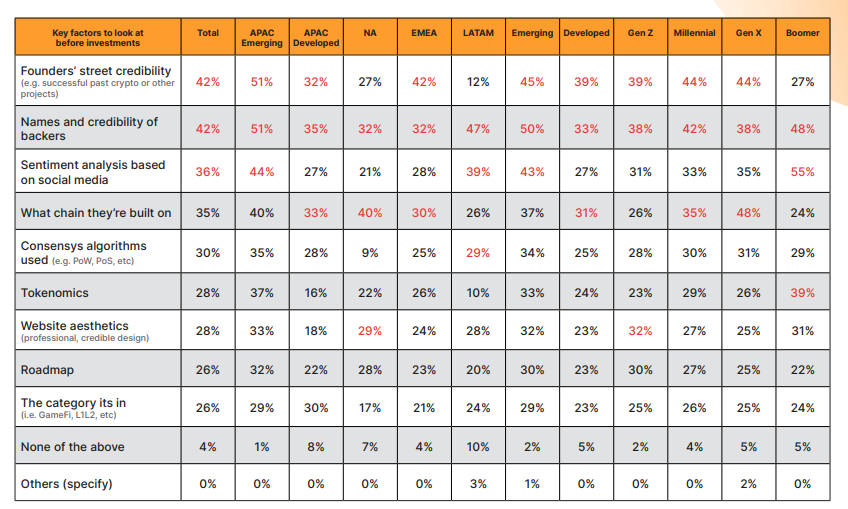

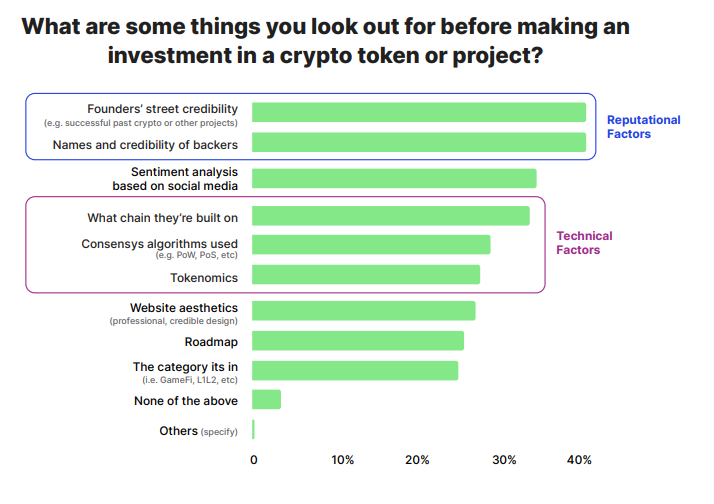

The reputation of a token project is more important to potential investors than the technical aspects of the project itself.

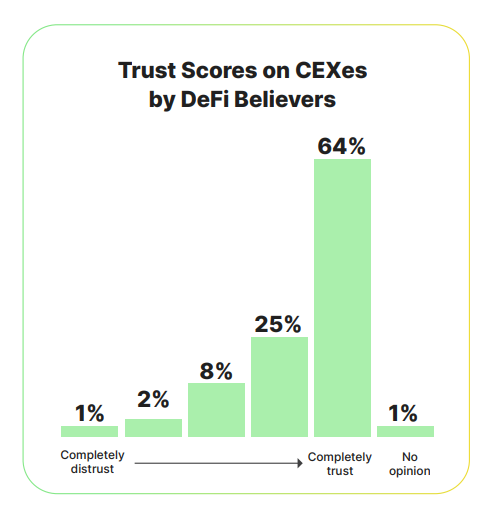

When compared to the approach that is used to select token projects, the day-to-day business tactic characteristics of centralized exchanges (CEXs) were preferred by a margin that is thirty percent larger than the weight given to reputational variables.

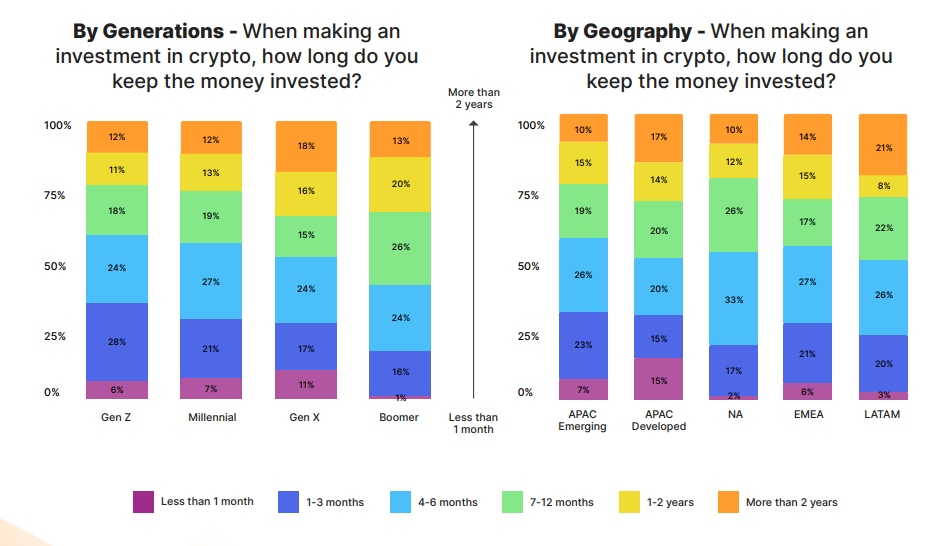

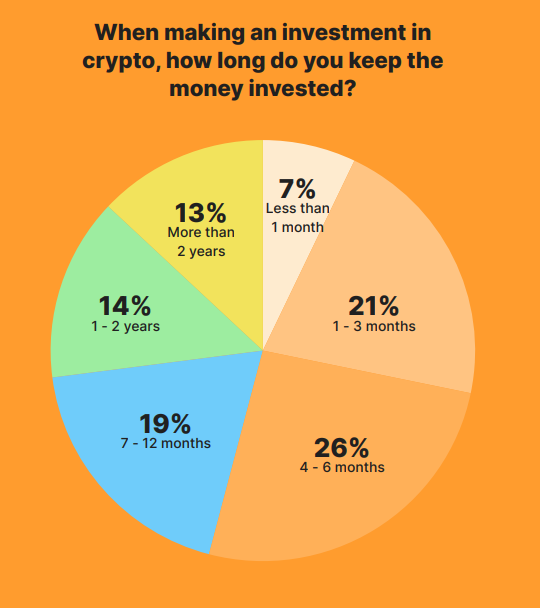

Crypto currencies have only been around for a few years. Still, investors have already shown a willingness to hold them for periods ranging between seven months to more than two years, demonstrating their confidence in the asset class's long-term growth potential.

Since they have been hodling for a minimum of six months, people of the Boomer and Gen X generations have the finest diamond hands.