The Hong Kong Virtual Asset Consortium (HKVAC) has updated its cryptocurrency indices, resulting in significant changes to its top 5 and top 10 crypto indexes. Notably, XRP has been removed from the top 5 global crypto index, with Solana taking its place.

Solana's Ascension and TRON's Recovery

Solana’s rise to the fourth-largest cryptocurrency by market capitalization last month was a key factor in its inclusion in HKVAC's index. Meanwhile, TRON has shown remarkable recovery from its downturn during the 2018-2020 bear market, rallying by 100% in 2023.

AVAX's Growing Appeal

Avalanche (AVAX) replaced TRON in the index, partly attributed to its growing appeal within traditional financial circles. Banks like JPMorgan and Citi have partnered with the Avalanche Foundation for asset tokenization initiatives, highlighting the increasing integration of traditional finance and blockchain technology.

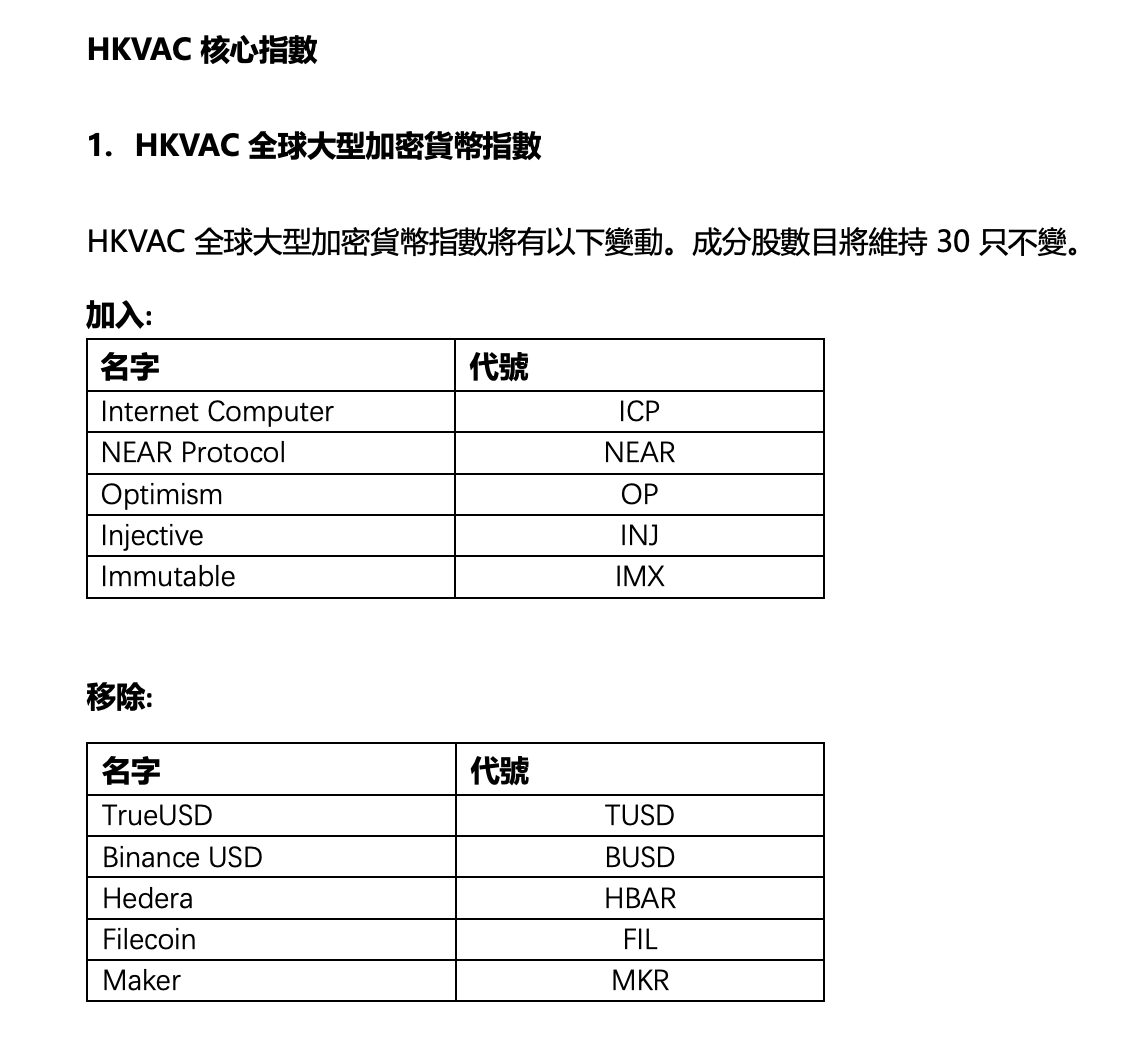

New Additions to the Large Crypto Index

HKVAC's global large crypto index welcomed newcomers like Internet Computer (ICP), Near Protocol (NEAR), Optimism (OP), Injective (INJ), and Immutable (IMX), reflecting the dynamic nature of the crypto market and the emerging significance of these digital assets.

Hong Kong’s Proactive Stance on Crypto

This index revision aligns with Hong Kong's proactive approach to the cryptocurrency sector. The region's financial regulator announced preparations to welcome spot crypto ETFs, following the U.S. SEC's approval of 11 spot Bitcoin ETF applications in January. Hong Kong's Securities and Futures Commission (SFC) insists that crypto transactions by these ETFs must be conducted through SFC-licensed platforms or authorized financial institutions, ensuring regulatory compliance.

A Shifting Crypto Landscape

The changes in HKVAC's crypto indexes underscore the evolving landscape of the cryptocurrency market. The inclusion and exclusion of certain cryptocurrencies reflect market trends, technological developments, and shifts in investor interest, further emphasizing the dynamic and fast-paced nature of this sector.