Spot Bitcoin ETF Demand Cools Off After March Peak

After a period of net outflows, the crypto market has seen a positive shift with net inflows of $862 million in the past week, compared to $931 million in net outflows the week prior. However, the enthusiasm for spot Bitcoin exchange-traded funds (ETFs) appears to be waning, with daily trading volumes dropping to $5.4 billion, a 36% decrease from the peak of $9.5 billion in early March.

Bitcoin Dominates Digital Asset Flows

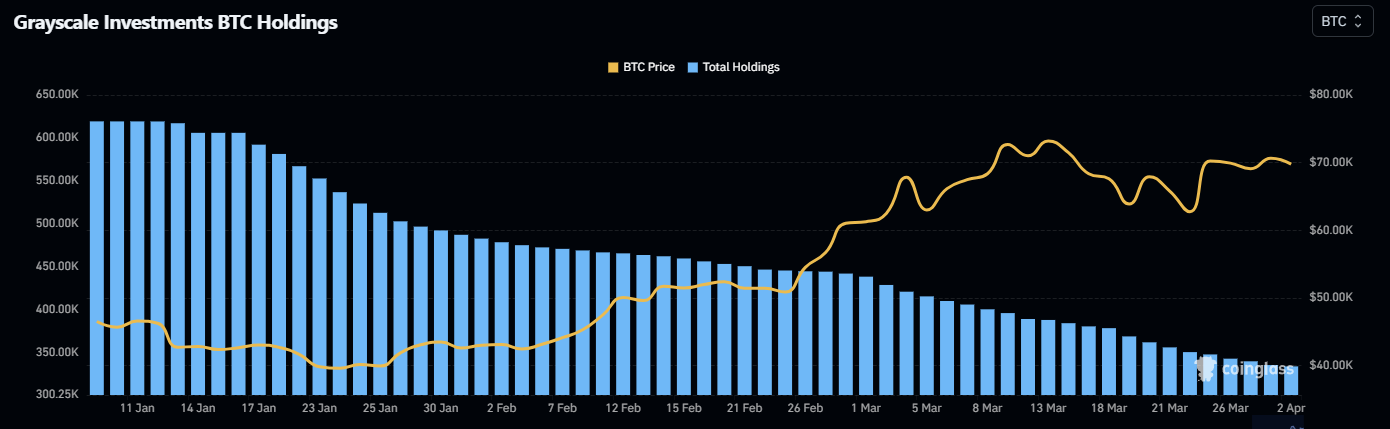

Bitcoin led the digital asset inflows with $863 million, primarily driven by ETF demand. Spot BTC ETFs recorded $1.8 billion in inflows, in stark contrast to the $965 million in outflows from the Grayscale Bitcoin Trust (GBTC). Despite the approval of spot BTC ETFs in the United States on January 11, GBTC continues to experience significant outflows, contributing to selling pressure on BTC prices over the past three weeks.

GBTC Outflows and BTC Price Impact

The ongoing outflows from GBTC, which continue to dominate ETF flows, have raised concerns about the selling pressure on BTC prices. Bitcoin has experienced a $4,000 drop in the past 24 hours, trading just above $66,000 at the time of writing. This price correction, which led to nearly $500 million in liquidations, comes ahead of the Bitcoin halving event scheduled for April 20. The options market has also shown signs of bearish sentiment with heavy put calls.

Ether and Altcoin Market Flows

Ether recorded its fourth consecutive week of outflows, with a $19 million loss this past week. Despite this, the altcoin market overall saw a net inflow of $18.3 million, with Solana's token leading with $6.1 million in inflows. The regional distribution of inflows and outflows revealed that the U.S. experienced the largest outflows at $897 million, while Europe and Canada combined saw $49 million in outflows.

📉 $500M liquidated as #Bitcoin drops 5.5%! 📉 Options market heats up with heavy put calls, suggesting bearish sentiment.

— Marcel Knobloch aka Collin Brown (@CollinBrownXRP) April 2, 2024

🐻Meme coins face strong selling pressure too. 📉 Is it fear of upcoming #BTC halving or broader market correction?

I believe the price will continue to… pic.twitter.com/pDhoZTxAeH