Matt Hougan, Chief Investment Officer of Bitwise Investments, was a guest on the podcast "Making Money with Matt McCall" not too long ago, where he discussed the current state of the crypto currency market and the types of assets that investors should take into consideration.

Hougan stressed (1) how important it is to have both Bitcoin (BTC) & Ethereum (ETH) in a portfolio, noting that Bitcoin is "still a very crucial crypto asset" and the asset that institutions feel the most comfortable owning. Ethereum is the second most popular cryptocurrency.

He continued by explaining that there is a huge market for Bitcoin, which is driven by institutions' acceptance of the crypto currency and the asset's reduced volatility.

When it concerns Ethereum, Hougan highlighted the substantial technological advancements that the ecosystem has undergone, mentioning the vast number of programmers and the constantly dropping cost of transactions as examples. He stated, "I'm excited about what's happening with Ethereum."

Hougan suggested considering the native coin of Cosmos (ATOM), calling it an "interesting altcoin if you desired to move beyond the big two." Bitcoin and Ethereum are the "big two" crypto currencies currently in circulation.

He emphasized the enthusiasm and activity regarding the asset, stating that it can propel the bitcoin market ahead at some point in the future.

You can catch the whole conversation here:

What do Institutional Investors think?

In a recent poll, CoinShares, which bills itself as "Europe's largest digital asset investment and trading group," wanted to get information about the opinions and behavior of investment managers in the crypto currency space. The survey was conducted to learn more about the digital asset space.

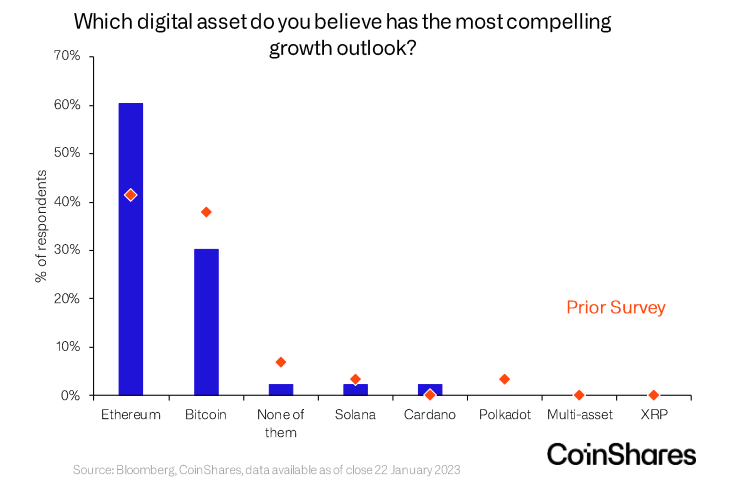

According to the findings (2) of the most recent edition of CoinShares' Digital Asset Quarterly Fund Manager Survey, sixty percent of the forty-three fund managers polled, who have a total of three hundred and ninety billion dollars worth of assets under management, genuinely think that Ethereum has the most considerable favorable economic prospects in the year 2023.

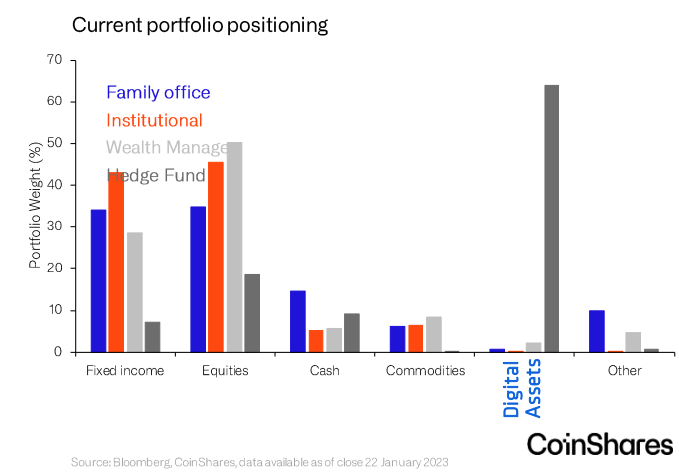

The poll also showed that investments in Bitcoin and Ethereum have been consolidated and that digital currencies are rapidly being incorporated in the portfolios of hedge funds, rising from 0.7% to 1.1% of total assets under management.

Client demand and market speculation have been the primary forces behind the growing trend of including digital assets in investing portfolios. It is interesting to note that some investors see possibilities in the current market.

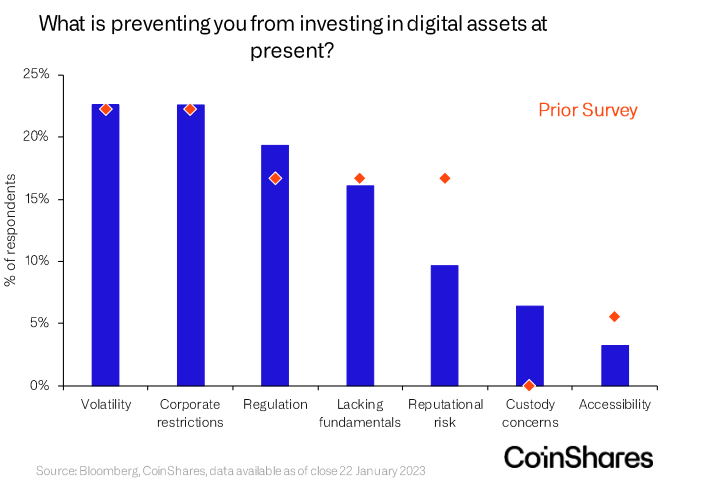

When participants were questioned about the factors that drove them to avoid participating in digital assets, the poll showed that the perceived danger of reputational damage had decreased but that regulation continued to be a concern.

Although the chance of legal restrictions being imposed by governments has lessened, the risks associated with custody and volatility have increased.